If you are currently interesting in growing your wealth without investing your money or time in the methods shown in my article 'Passive Income and You', it is best to save your money. This can be done through savings!

Savings Tax

When you are earning a basic form of income, you would normally be taxed by the government in the form of income tax. This is unavoidable as part of your income is eaten up by the Big Brother. So, in addition to that taxation, in your own private records you should add a separate column for your "Savings Tax". Set a percentage to tax yourself after you have taken off your expenses and your "forced" taxes.

If you tax yourself 10% of your salary as "Savings Tax" with an income of $1,000 a month, you are saving $100 a month. Over a year, you would have saved $1,200. If we were a bit more generous and say you have $10,000 a month, you would be saving at least $12,000 a year. You may go over Fixed Deposits for a low-risk interest rate, allowing a small amount of passive income per annum.

A Compounded Dollar

The compounded dollar is a saving method which is by having a small compounding saving throughout the year on a weekly basis. For example, you could save $1 on Week 1 and $52 on Week 52. This could be done in reverse depending on your spending and saving habits. This means that if you are able to afford saving $52 at the start of the year, so be it. Otherwise, you can start small and grow it. In total, you would save $1,378 per annum. It is simple maths and you don't have to go the bank unless you are going to put your lump sum into the bank.

Simple Saving Method

This is less complicated version of "A Compounded Dollar", save a flat rate of your money in a bin. If you save even a dollar a day, you save a small $365 a year. However, if you decide to save $5 a day, you will save $1,825 a year.

-----------------------------------------------------------------------------------------------------------------------------

The best method to saving yourself is not to have a clever way of saving your salary though. The smart way would be to make sure you don't spend unnecessarily. Sounds basic? Well, you would be surprised by how often you spend money on things that are pointless or unnecessary.

Start a shopping list

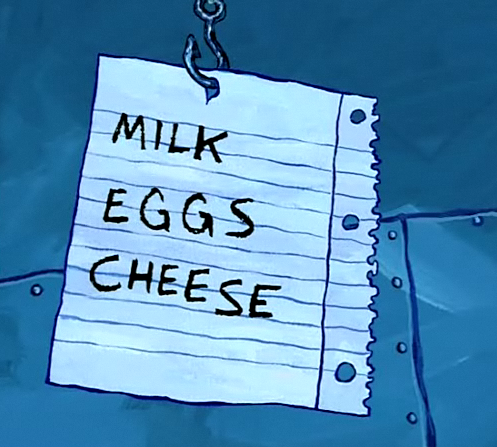

Before you are about to go shopping, write down exactly what you want or need. Supermarkets are organised in a certain way to make sure that you are trapped inside, buying things you never thought you wanted or needed. If you have a set goal of what you want to purchase, buy nothing else. Don't be "Oh, I think I may need this". Be like this, "This is what I have came for".

Be wary of sales

Personally, I have fallen prey to amazing sales. I would end up buying more of something I don't need or never thought I wanted. What will I do with a brand of chips I am not especially fond of after buying 10 bags because it was 50% off. Keep in mind that each time you buy something from a sale, you are still spending. For every $50 you spend, you feel that you are saving $100 but in actuality, you are still spending $50.

Cut up the cards

I am not fond of liabilities. One of the biggest ways to rack up debts are credit cards. You will never need more than two. One for your personal usage and one for absolute emergencies. The one you allocate for personal usage should also only be used when you are making a large, necessary purchase.

Deal with Cash

Whenever you are buying something, deal with cash. Avoid using cards whether credit or debit. Whenever you have cash on hand, you will likely spend less. This is because when you are primarily using a card, your cash becomes digital and the illusion of infinite money comes in. However, if your cash is in your wallet, it becomes a finite resource that you can use.

Avoid depreciating assets

You see that hot million dollar car that runs from 0-200 in a second? You know, that one car that costs a winning lotto jackpot? Well, odds are, you don't need it. And if you don't get it, you are better off in the long run. A car is an example of a depreciating asset, its value goes down as it ages. Unless it is a highly sought after vintage car, you will never get your money's worth back. Another example of a depreciating asset is tech. If you don't need a new phone, your current one works fine. Shelling out another thousand dollars over some minor RAM improvements will never be worth it. Even trading in your current phone won't net you much of a discount.

Don't gamble in games you can't win

Whenever I walk around the shop lots a few roads away from my house, I would see that there are people lined up in the lottery center, hoping for their big break. I was honestly surprised that this information would actually be necessary but apparently it is. GOING TO THE LOTTERY WON'T MAKE YOU RICH! It is as silly as burning up your money. The casino won't work either unless you are highly skilled and you'd most likely get kicked out if you win too much.

If you want to gamble, don't bet on horses. Wanna know the best odds? Investments. If you want to play with your money, take it to the stock market and ,with prior research, go bet which stocks will go up. Odds are, you will have a higher rate of return and if you are on site buying and selling, as a participant, you should be able to appreciate more of a high than just being a spectator.

Fuel bills

If you are living in a country with a functioning public transport and expensive petrol, stave off on the fuel gauge. Do the math on your own as this differs between countries but just think about it! Will it be cheaper for you to take the train or drive? If it is a matter about being late, then take off a little earlier.

Phone Bills

If you are still paying for your phone bills separately from everything else, you need to know that there is an alternative. Many companies offer Internet services as part of their package and they can use VoIP to let you call people as part of your internet plan. Personally, I done away with my land line since no one calls it anyway. If you need someone to call your household, it is better off that they know your handphone number so they can call you that way or even use whatsapp to call you. The internet is truly a magical place.

Decide between NEED and WANT

Whenever you want to buy something, do you need it? Or do you just want it? If you have expendable income that you don't mind shelling out then go ahead, satisfy your wants. However, if you are desperate to save, knowing the difference between needing and wanting will do you some good.

Therefore, I wish you the best with your journey to save yourself from financial debt. If you want more tips or would like to share tips of your own. Kindly leave a comment in the comment section below.

Sharing is Caring,

Sean Wang

0 comments:

Post a Comment